By RunHOA · Last updated August 21, 2025

Use this simple guide to understand hoa budget allocation—how boards plan operating costs and reserves, and how to read your community’s numbers. You’ll see where dues go, what drives increases, and how to avoid surprise assessments with better planning and transparency.

- TL;DR: Your dues fund operations (today) and reserves (tomorrow).

- Expect a written budget, a reserve contribution, and insurance every year.

- Typical example: ~25%–35% maintenance, ~15%–30% reserves (varies by community).

- Big drivers of dues: aging assets, insurance, utilities, and vendor contracts.

- Rebid large contracts every 24–36 months to control costs.

What is a budget? · Steps · Sample breakdown · Operating vs. Reserves · FAQ

What is an HOA Budget?

An HOA budget is a one-year plan for income and expenses. It covers common-area upkeep, insurance, utilities, management, and a planned contribution to the reserve fund for future repairs (roofs, paving, pool equipment). It’s guided by your CC&Rs (your community’s rulebook), bylaws, and a current reserve study.

How HOA Budgets Are Created (Step-by-Step)

- Review last year: Compare budget vs. actuals; note overruns in utilities, landscaping, repairs, or insurance.

- Forecast costs: Update vendor bids, add inflation, and schedule projects from the reserve study.

- Fund reserves: Set the annual reserve contribution to meet the study’s recommended funding level.

- Set dues: Divide total expenses by units (or per CC&Rs formula) and model scenarios.

- Approve & publish: Board adopts the budget per bylaws; share the packet, meeting notice, and minutes with owners via the RunHOA Calendar.

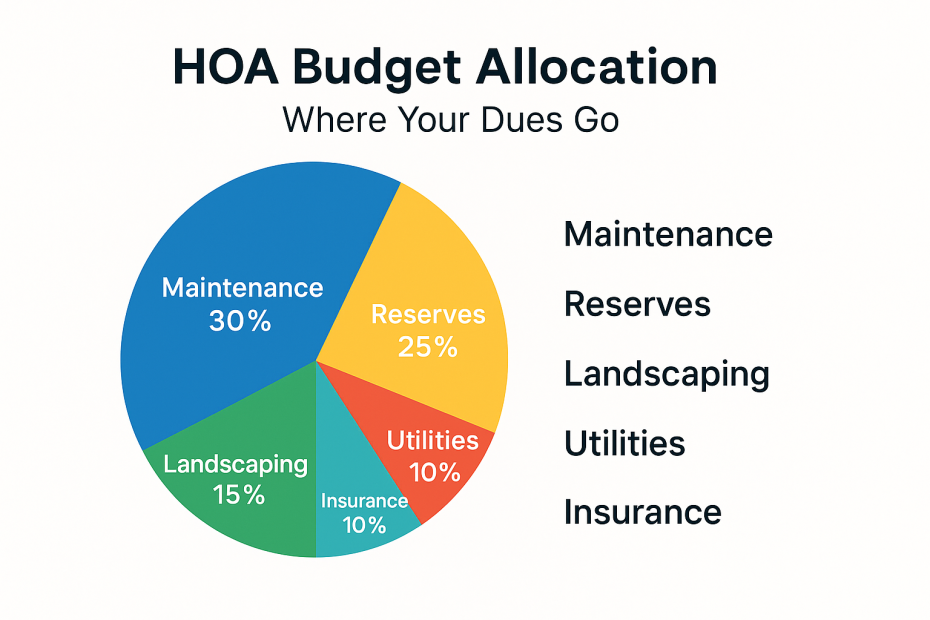

hoa budget allocation: sample breakdown

Example only—your numbers will vary by size, amenities, age, and location.

| Category | What it covers | Example % |

|---|---|---|

| Maintenance & Repairs | Common areas, pools, buildings, roads, equipment | 30% |

| Landscaping & Grounds | Lawns, trees, irrigation, seasonal cleanups | 15% |

| Utilities (Common) | Water/irrigation, lighting, electric/gas, trash | 10% |

| Insurance | Property & liability for shared assets | 10% |

| Reserve Fund | Future capital projects (per reserve study) | 25% |

| Admin & Management | Management fees, accounting, legal, mailings | 10% |

How Your Dues Are Used (Operating vs. Reserves)

Operating budget (today’s costs)

- Common-area maintenance: parks, paths, pool, clubhouse repairs.

- Landscaping: mowing, pruning, irrigation checks, mulch.

- Utilities: lights, water for irrigation/pools, shared trash service.

- Insurance: property/liability for common assets.

- Admin/management: dues collection, violations, minutes, mailings, legal.

- Amenities & services: snow removal, security, pest control, events (if applicable).

Reserve fund (tomorrow’s costs)

- Large, infrequent projects: roof replacements, asphalt milling/resurfacing, pool resurfacing, mechanicals.

- Amounts are set by a reserve study and updated every few years.

- Aim is to prevent special assessments by saving steadily.

What Drives Dues Up (and Down)

- Aging assets: older roofs, pavement, and pools need more repairs.

- Insurance markets: premiums and deductibles can change sharply year-to-year.

- Utilities: rate hikes and irrigation use.

- Amenities: more features (gym, gates, elevators) = higher upkeep.

- Management style: self-managed can save on fees but needs more volunteer time.

- Vendor contracts: rebidding and service levels affect cost.

How to Read Your HOA Financial Packet

- Budget vs. actuals: spot trends early (e.g., utilities overruns).

- Reserve study & schedule: components, lifecycles, and project years.

- Balance sheet & cash: look for a separate reserve account.

- Delinquency/arrears: higher late balances can strain cash flow.

- Board minutes: decisions on bids, assessments, and policy changes (share via Document Library).

Practical Ways to Control Costs

- Update the reserve study every 3–5 years; adjust contributions annually.

- Rebid large contracts every 24–36 months; define clear service levels.

- Audit or review financials yearly; consider professional accounting.

- Use e-billing and online payments to cut printing/postage and reduce late fees with RunHOA Online Dues.

- Publish budgets, minutes, and policies in a searchable Document Library.

- Use owner polls to test appetite for projects via RunHOA Surveys and share notices with RunHOA Communications.

FAQ

How much should our HOA contribute to reserves?

There’s no one number for every community. Most boards follow the reserve study’s recommendation, which estimates component lifecycles and funding needs. Many associations land between 15%–40% of the budget, but yours may differ based on aging assets and project timing.

Why did dues increase this year?

Common reasons include insurance premium changes, utility rate hikes, catching up on underfunded reserves, or new service levels in landscaping/maintenance. Ask for the budget packet and compare last year’s “actuals” to this year’s forecast to see the drivers.

What’s the difference between operating expenses and reserves?

Operating expenses cover routine, recurring costs (landscaping, utilities, admin). Reserves are savings for large, future projects (paving, roofs, pool resurfacing). Healthy reserves reduce the risk of special assessments.

Can owners vote on the budget?

Rules vary. Some states and CC&Rs use board adoption with owner ratification (budget stands unless a majority rejects). Others require a membership vote. Check your bylaws/CC&Rs and meeting notice for the process, quorum, ballots, and proxies.

Where can I find our budget and financials?

Budgets, reserve disclosures, and minutes should be shared at least annually and kept in the association’s document library. If you use RunHOA, see Documents and the Calendar for meeting dates.

Make budgeting easier with RunHOA

- Cut late payments with RunHOA Online Dues—automatic reminders, easy checkout, and late-fee rules.

- Keep budgets, minutes, and reserve studies organized in the RunHOA Document Library.

- Share notices and results with RunHOA Communications and simplify approvals via e-Voting.

References

- Community Associations Institute (CAI)

- Nolo: Living Under a Homeowners’ Association

- CFPB: Debt collection (your rights)

- IRS: About Form 1120-H

- California Civil Code (Davis-Stirling Act)

Announce budget hearings in one click using RunHOA Communications.