If you live in a community association, you pay dues. This guide delivers HOA fees explained—what they are, what they cover, how they’re set, and what happens if you miss a payment. You’ll also learn how reserves work, why special assessments happen, and practical ways to keep increases reasonable.

- Dues fund shared costs: maintenance, insurance, utilities, management, and reserves.

- Typical range: many single-family HOAs run ~$50–$300/mo; condos and amenity-heavy communities can be higher.

- Reserves matter: target ~15–40% of the budget to avoid special assessments.

- Set by budget: the board adopts an annual budget and divides costs across owners.

- Non-payment risks: late fees, collections, liens, and in some states, foreclosure.

HOA fees explained: what they cover (quick list)

- Common-area upkeep: landscaping, repairs, snow removal, streets/sidewalks, ponds, playgrounds.

- Amenities: pool, gym, clubhouse, courts—cleaning, chemicals, resurfacing, equipment.

- Utilities (shared): irrigation water, lighting, gate power, facility gas/heat, community trash service.

- Insurance (association): liability + property for common elements; condos/townhomes often include exterior.

- Management & admin: accounting, audits, compliance, ARC/ACC processing, website, mailings.

- Reserves: savings for big projects—roofs, paving, mechanicals, clubhouse refresh.

Want transparency? Share budgets and minutes in a central library with RunHOA Documents and post updates via RunHOA Communications.

How HOAs set and adjust dues

- Build the budget: estimate next year’s operating costs, insurance, utilities, contracts, plus reserve contributions guided by the reserve study.

- Adopt at a meeting: many states require an open board meeting, owner notice, and recorded minutes; some require owner ratification.

- Allocate fairly: split costs per CC&Rs/bylaws (equal shares, percentages, unit factors, or limited-common formulas).

- Publish and bill: send summaries, due dates, and any change to late-fee policy.

Make billing painless with RunHOA Online Dues and keep ledgers clean with RunHOA Accounting. Use quick owner polls for feedback with RunHOA Surveys.

State law example (Florida): Florida HOAs operate under Chapter 720 of the Florida Statutes. Budget adoption and reserve rules may differ from other states. Always check your governing documents and state code.

Fee example (illustrative): Annual budget = $180,000; 100 homes → $180,000 ÷ 100 = $1,800/year per home → $150/month. If reserves need +$24,000, dues rise by $20/month.

Reserves, special assessments, and long-term costs

A reserve study estimates the useful life and replacement cost of big items (paving, roofs, pool systems). Funding before things fail spreads costs fairly and reduces surprises.

- Healthy target: many communities aim for 15–40% of the annual budget to go to reserves (your study sets the real number).

- When reserves are low: boards may raise dues or levy a special assessment.

- Condos vs. HOAs: condo fees are often higher because exteriors and shared buildings are included.

Track reserve transfers in RunHOA Accounting and store the reserve study in RunHOA Documents.

What happens if you don’t pay (late fees, liens, collections)

- Late fees: many CC&Rs set a fee (e.g., $25–$50) after a grace period (often 10–30 days).

- Collections: reminders → demand letters → third-party collections; interest may accrue.

- Liens: associations typically record a lien for unpaid assessments; some states allow foreclosure.

- Avoid trouble: ask for a payment plan early; boards should apply policy consistently to avoid Fair Housing concerns.

Reduce delinquencies with automated billing and reminders in RunHOA Online Dues and keep owners informed through RunHOA Communications. For association tax filings, see RunHOA Taxes & 1120-H.

Ways to keep fees stable

- Bid contracts: rebid landscaping/insurance every 2–3 years; review scope.

- Maintenance plans: preventive care beats emergency repairs.

- Utility audits: right-size irrigation schedules and LED streetlights.

- Policy hygiene: align delinquency policy with the CC&Rs and state law; apply consistently.

- Owner engagement: publish a one-page budget summary and run a quick owner survey with RunHOA Surveys.

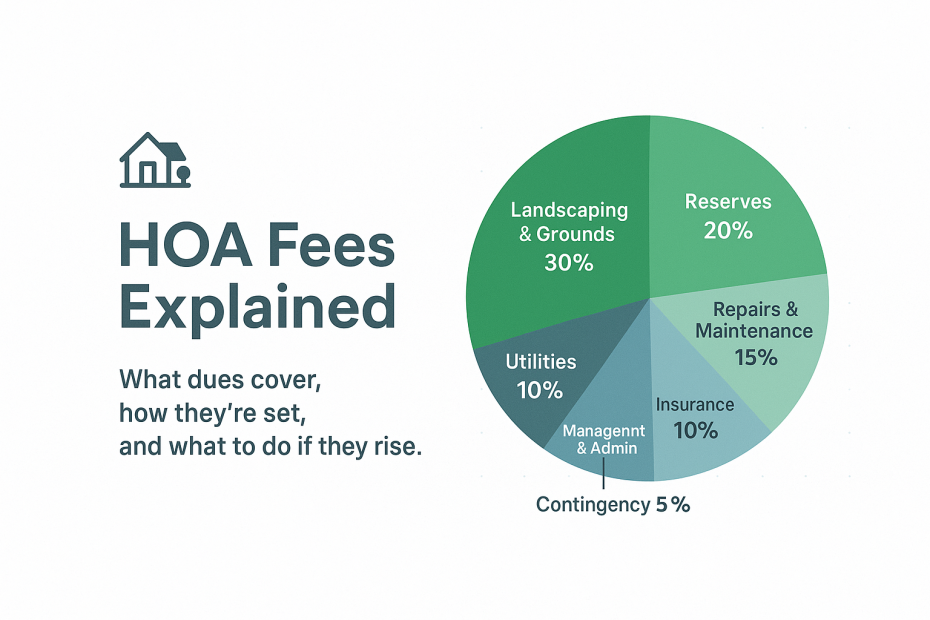

Example: typical fee allocation (illustrative)

| Category | % of Budget | Notes |

|---|---|---|

| Landscaping & Grounds | 30% | Mowing, pruning, seasonal color, irrigation care |

| Repairs & Maintenance | 15% | Playgrounds, sidewalks, signage, lighting |

| Utilities | 10% | Irrigation water, streetlights, facility power/gas |

| Insurance | 10% | General liability + property for common elements |

| Management & Admin | 10% | Accounting, audits, postage, software |

| Reserves | 20% | Based on reserve study targets |

| Contingency | 5% | Unplanned small items |

How to read your statement & budget (5 steps)

- Grab documents: CC&Rs, bylaws, current budget, reserve study, and last annual meeting minutes from your document library.

- Find due dates & amounts: note monthly/quarterly cadence, grace period, and late-fee policy.

- Match line items: compare your statement to the budget categories and reserve plan.

- Check reserves: confirm annual contribution aligns with your reserve study’s recommendation.

- Ask early: send questions before adoption using your association’s communication portal or at the budget meeting (watch for notice and quorum rules).

FAQs

Are HOA dues the same as special assessments?

No. Dues (assessments) are the regular, recurring charges. A special assessment is a one-time charge for a specific shortfall or project, often due to low reserves or emergencies.

Can I withhold dues if services are poor?

Usually no. Most CC&Rs require payment regardless of disputes. Use board meetings, written requests, or mediation to address service issues; withholding can trigger collections or liens.

Are HOA fees tax-deductible?

For a primary residence, typically no. If you rent the property, dues can be an expense. Associations file taxes separately (often IRS Form 1120-H). Learn more in RunHOA Taxes.

What’s a reasonable annual increase?

It depends on inflation, contracts, and reserve needs. Many communities see modest annual adjustments (e.g., 3–7%) to avoid large catch-up hikes and special assessments.

Who pays for the roof or exterior?

In single-family HOAs, owners often maintain their own structures. In condos/townhomes, exteriors may be association responsibility. Check your CC&Rs and maintenance charts.

Make dues simple with RunHOA

Cut late payments with RunHOA Online Dues—auto reminders and easy checkout—keep docs organized with RunHOA Document Library, and gather owner input with RunHOA Surveys.

References

- Community Associations Institute (CAI) – budgets, reserves, governance

- CFPB – Your rights when a debt collector contacts you

- IRS – About Form 1120-H for homeowners associations

- Florida Statutes – Chapter 720 (HOAs) index

Need simpler meeting prep? Try RunHOA e-Voting for budget ratification ballots and proxies.