Even though your HOA may have a filing requirement, it doesn’t mean it will have a tax liability. The vast majority of HOA income will likely be deemed exempt income. Accordingly, it will be exempt from taxation as long as the HOA qualifies. The IRS still expects to see an HOA tax return every year. RunHOA helps you do that by getting the data together for filing your tax form. You can easily categorize income and expenses in RunHOA with tax time in mind, so it’s easy for you (or your accountant) to file. At tax time you have all the information you need without any of the complexity.

Steps to setup and generate your HOA Tax Form report

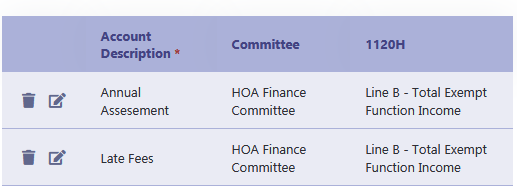

1. Categorize Income and Expenses

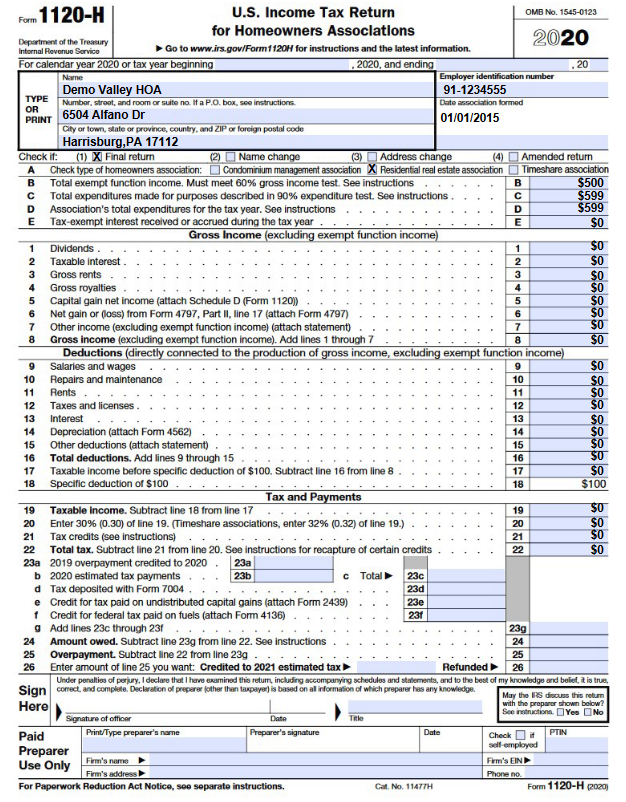

2. Run the 1120H Form

The taxes are automatically calculated for you in your Finance Module and displayed on the 1120H tax form for easy tax preparation in RunHOA

In Conclusion

Check out the Demo Account here

HOA Tax Form creation feature is included in RunHOA by CloudInfoSystems