Homeowners Associations (HOAs) require meticulous financial tracking and management. While general accounting software like QuickBooks offers a broad range of features, it often misses the mark for the specific needs of HOAs. RunHOA steps in to fill this gap with a Chart of Accounts designed explicitly with HOAs in mind, delivering a level of customization and clarity that generic accounting solutions can’t match.

Understanding the Chart of Accounts in HOA Management: The Chart of Accounts is the backbone of any accounting system. It’s where every financial transaction is categorized and recorded. For HOAs, this system needs to be particularly robust due to the unique nature of HOA finances – from managing assessments and dues to tracking expenses for maintenance and community events.

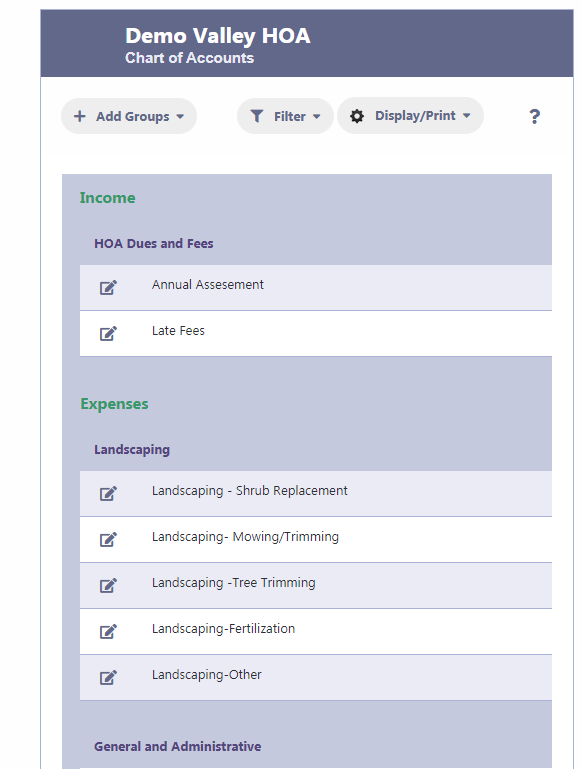

RunHOA’s Superior Implementation

- Tailored to HOA Needs:

- RunHOA’s Chart of Accounts comes with pre-defined account groups and accounts that align with standard HOA financial practices, unlike the one-size-fits-all approach of platforms like QuickBooks.

- Simplified Bank Account Integration:

- Adding and managing bank details in RunHOA is intuitive. It’s designed to handle multiple accounts seamlessly, whether they’re for checking, savings, or processing credit card payments and ACH Transfers with integrations like Stripe.

- Customizable Account Groups:

- While QuickBooks requires a fair amount of tweaking to fit the HOA model, RunHOA allows for immediate customization of account groups to reflect the actual financial structure of your HOA.

- Committee and Tax Form Associations:

- Unique to RunHOA, you can associate income and expense accounts with specific committees for detailed reporting and attach 1120H tax form codes for accurate tax preparation, something general accounting software lacks.

- User-Friendly Interface:

- RunHOA offers an interface that simplifies the process of adding income and expense groups. The ease of editing and adding accounts under these groups is unparalleled, making financial management less of a chore.

The RunHOA Chart of Accounts Advantage

- Committee-Wise Reporting:

- RunHOA acknowledges the collaborative nature of HOA management by allowing accounts to be linked with committees, paving the way for clear, concise committee-wise financial reporting.

- 1120H Compliance Made Easy:

- Tax compliance is a breeze with RunHOA, as you can associate accounts with 1120H codes directly, ensuring that every transaction is appropriately categorized for tax purposes.

- Real-Time Financial Snapshot:

- The ‘Filter/Summary’ feature in RunHOA provides a real-time summarized view of your finances, something that is often cumbersome to achieve in QuickBooks without extensive customization.

- Versatile Display and Export Options:

- RunHOA understands that financial data needs to be versatile. With just a few clicks, you can display or export your Chart of Accounts to various formats such as PDF, Word, Excel, or ready for print.

Conclusion

In the realm of HOA financial management, RunHOA’s Chart of Accounts stands out for its thoughtful design and specialized functionality. It addresses the pain points of using a generic accounting system for the nuanced needs of HOA management. The ease of use, coupled with robust reporting and compliance features, ensures that HOAs can manage their finances with precision and ease, offering a clear advantage over traditional methods like QuickBooks.