HOA Budgeting is the cornerstone of financial governance in a Homeowners Association (HOA). It’s a complex dance of predicting the future, learning from the past, and balancing the present needs of the community. A meticulously crafted budget not only guides an HOA’s financial decisions over the year but also ensures financial transparency and accountability to its members. In this blog, we will explore the intricacies of HOA budgeting and how RunHOA’s budget module can be a game-changer for your community’s financial management.

The Art of HOA Budgeting

Budgeting for an HOA involves projecting both the income typically derived from member dues and other fees, and the expenses required to maintain and enhance the community. This includes routine maintenance, emergency funds, capital improvement projects, and savings for future needs.

Predictive Planning: Estimating the upcoming year’s costs and revenues requires a careful analysis of historical data, future projections, and a keen understanding of the community’s goals.

Member Involvement: Transparency in the budgeting process promotes trust within the community. A clear and comprehensible budget helps members understand where their dues are going and why they are necessary.

RunHOA’s Budget Module: A Financial Compass

RunHOA’s budget module is designed to simplify and streamline the budgeting process. It’s an interactive tool that enables HOAs to create, manage, and communicate their budget effectively.

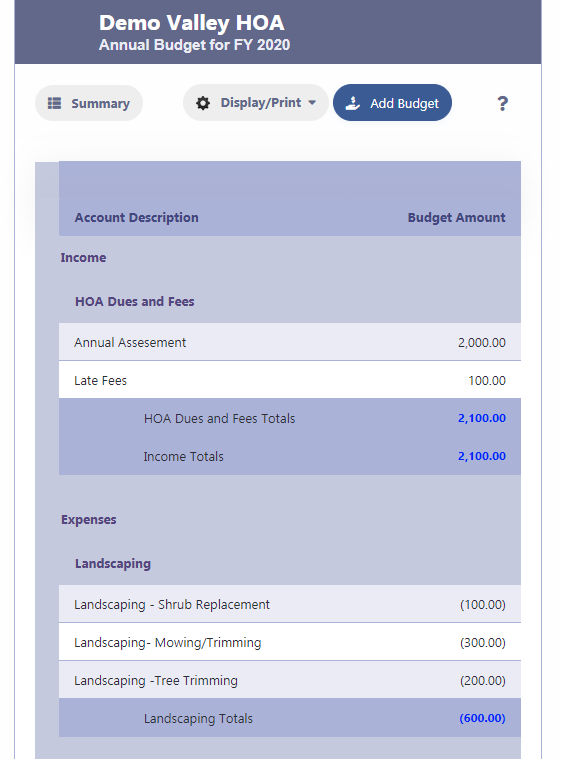

Intuitive Budget Creation: With RunHOA, setting up the annual budget is a straightforward process. The software’s user-friendly interface allows for quick input of income and expense forecasts.

Dynamic Adjustments: As circumstances change, the budget can be easily updated to reflect new financial realities, ensuring the HOA remains nimble and responsive.

Implementing the RunHOA Budgeting Solution

Navigating to the Budget: In RunHOA, the Budget section under Financials is where the fiscal magic happens. It’s here that you can begin the process of outlining your financial year.

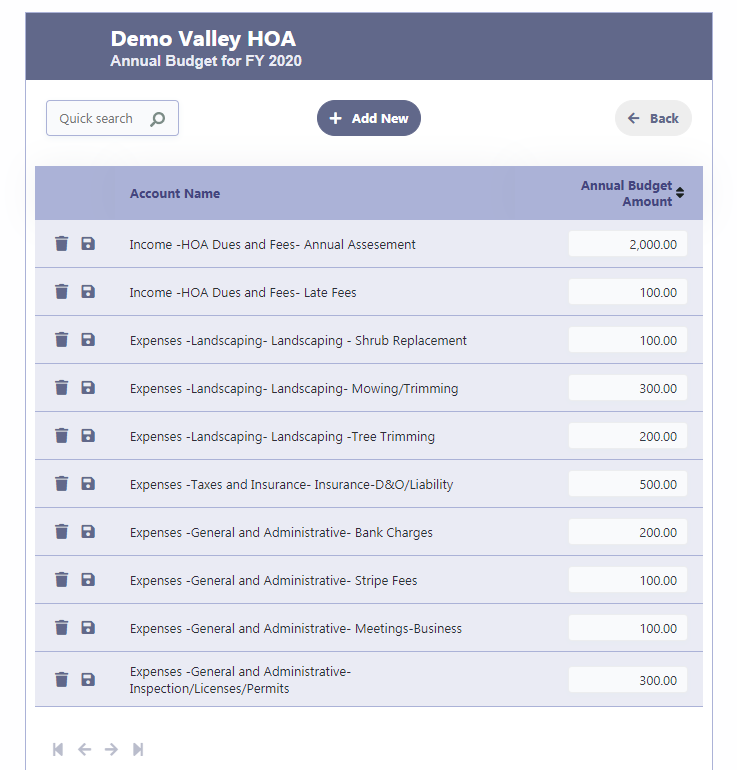

Adding Budget Items: For each category of revenue and expense:

- Add New Entries: Click “Add New” to input budget amounts for each category.

- Select Accounts: Use the dropdown to choose the relevant account that corresponds to the budget item.

- Plan the Amounts: Enter the anticipated amounts for the coming year.

- Save Your Work: With a simple click on the disk icon, your entry is recorded.

Budget Summaries and Visualizations

Custom Reports: RunHOA allows you to generate customized reports, offering a high-level overview or detailed breakdowns of the budget.

Visual Charts: For many, financial data is easier to digest in visual form. RunHOA’s charts translate numbers into insights, providing a clear picture of the HOA’s financial plan.

Sharing with Members: RunHOA’s reporting and charting capabilities mean that sharing the budget with community members is as easy as a few clicks, ensuring all members are well-informed and engaged in the association’s financial health.

The RunHOA Advantage

Streamlined Process: What used to be a time-consuming task becomes efficient and manageable, freeing up time for board members to focus on other important community matters.

Accuracy and Transparency: With all financial data in one place, the chances of errors reduce. Transparency is naturally enhanced when the budget is accessible and comprehensible.

Community Confidence: A well-managed budget is the hallmark of a well-managed community. RunHOA provides the tools to build that confidence among members.

Conclusion

An HOA’s budget is more than a series of numbers—it’s a reflection of the community’s priorities and a roadmap for its future. With RunHOA’s budget module, HOAs have at their disposal a robust tool that simplifies financial planning, fosters transparency, and ensures that every dollar is working towards the community’s goals. In the world of HOA management, RunHOA’s budget module isn’t just useful; it’s indispensable for crafting a financial plan that makes sense, cents, and community sense.

Sample Projected Income:

- Monthly HOA Dues:

- Description: Income from regular monthly dues collected from homeowners.

- Budget Amount: $120,000 (assuming $200 per unit from 50 units over 12 months).

- Special Assessment:

- Description: Additional fees collected for specific projects or emergency funds.

- Budget Amount: $30,000 (one-time assessment).

- Late Fees:

- Description: Fees collected from late payments.

- Budget Amount: $2,000.

- Facility Rentals:

- Description: Income from renting out community spaces.

- Budget Amount: $5,000.

- Interest Income:

- Description: Interest earned from HOA’s savings account.

- Budget Amount: $1,000.

Sample Projected Expenses:

- Landscaping and Grounds Maintenance:

- Description: Regular maintenance of common areas.

- Budget Amount: $25,000.

- Utilities:

- Description: Water, electricity, and gas for common areas.

- Budget Amount: $15,000.

- Repairs and Maintenance:

- Description: Routine repairs and upkeep of community facilities.

- Budget Amount: $20,000.

- Insurance:

- Description: Property and liability insurance for the HOA.

- Budget Amount: $18,000.

- Reserve Fund Contribution:

- Description: Savings for future large projects and unforeseen expenses.

- Budget Amount: $20,000.

- Community Events:

- Description: Costs associated with community gatherings and events.

- Budget Amount: $7,000.

- Administrative Costs:

- Description: Office supplies, legal fees, management fees, and other administrative expenses.

- Budget Amount: $10,000.

- Capital Improvements:

- Description: Major one-time expenses for improvements to the community.

- Budget Amount: $30,000.

Using RunHOA’s Budget Module:

Within RunHOA, each of these line items would be entered into the budget module by accessing the “Add Budget” section. The platform allows for categorization into income and expenses and offers tools for adjusting these figures as estimates become more precise or as actual figures come in throughout the fiscal year.

To generate reports or visualize the budget, RunHOA provides charting tools that can help the board and homeowners see where the money comes from and where it is projected to go. This visual component is crucial for transparency and for assisting members in understanding the HOA’s financial health and priorities.

This example is a basic framework that an HOA might use to get started with RunHOA’s budget module. The actual budgeting process would be more detailed and tailored to the specific needs and circumstances of the HOA.