How Can We Help?

Transaction Reports

Overview

The Transaction List module in RunHOA is a versatile reporting tool that allows users to view and analyze financial transactions based on various criteria such as account groups, committees, and contact names. This module facilitates the generation of detailed and summary reports that are essential for financial oversight and review.

Transaction Report By Account Group

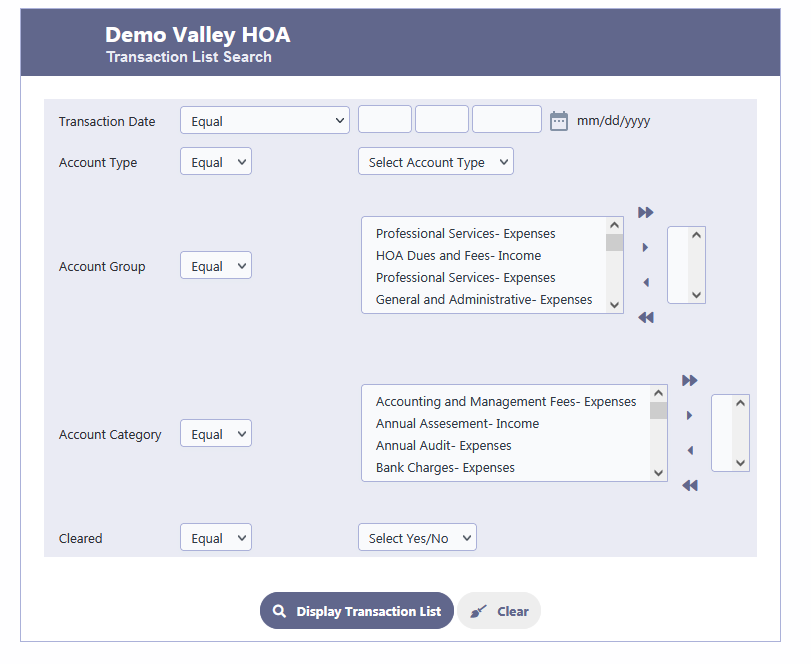

Search Criteria:

- Transaction Date: Select a range or specific transaction dates to filter the report.

- Account Type: Filter by Income or Expense to isolate specific types of transactions.

- Account Group: Choose one or several account groups to narrow down the transactions.

- Account Category: Select from different account categories for a more detailed report.

No mandatory criteria are needed. Leaving fields blank will display all transactions.

Report Details:

Each transaction row includes:

- Transaction Date: The date when the transaction was recorded.

- Account Category: The category to which the transaction is assigned.

- Bank Account: The bank account from which funds were withdrawn or into which funds were deposited.

- Name: The payee or payer involved in the transaction.

- Check Number: Reference number for the payment method, if applicable.

- Memo: A brief description or note about the transaction.

- Cleared: An indication of whether the transaction has been cleared by the bank.

- Amount: The monetary value of the transaction, showing deposits as positive amounts and withdrawals as negative amounts.

Continuing from the transaction row breakdown, the report includes several interactive buttons and features that enhance the functionality and user experience:

- Quick Search: This feature allows users to quickly locate specific transactions within the report by entering relevant keywords or values.

- Back: This button navigates back to the previous screen or search criteria input area, allowing users to modify their search or select different reporting options.

- Sorting: Users can sort the transactions based on any column heading, such as by date, amount, or name. This can help in organizing the data in ascending or descending order according to the user’s preference.

- Display/Print: This dropdown menu gives users options for displaying the report on the screen in different formats or printing a hard copy. Users can also export the report to various file formats such as PDF, Word, or Excel for further analysis or record-keeping.

- Columns: This feature allows users to customize the view of the report by selecting which columns to show or hide. This can simplify the report by removing unnecessary information or adding additional details as required.

- Summary: Clicking on this button will toggle the view to a summary format. In the summary view, instead of listing individual transactions, the report will display totals for each account group, providing a quick overview of the financial activity within each category.

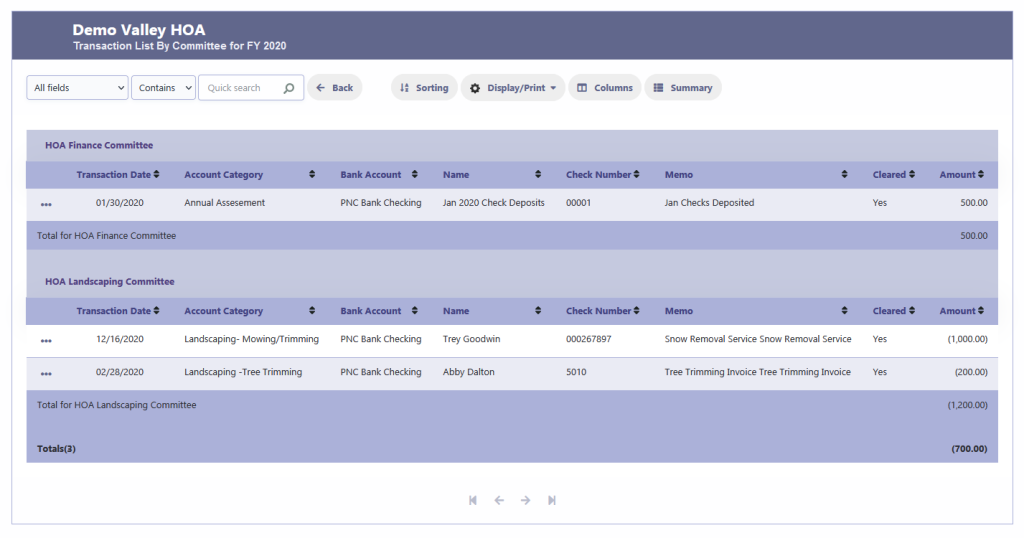

Transaction Report By Committee

The Transaction List by Committee report in RunHOA provides a detailed view of all transactions filtered by specific committees for a given fiscal year. This report allows HOA managers and committee members to track the financial activity attributed to various committees, facilitating transparency and aiding in financial planning and review.

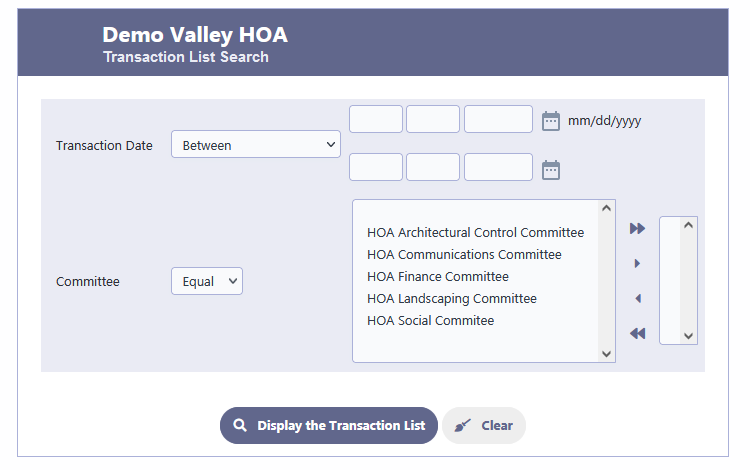

Search Criteria:

- Transaction Date: Specify a date range to filter transactions that occurred within a particular period.

- Committee: Select one or multiple committees to view transactions associated with those committees. Leaving this field blank will include all committees in the report.

Report Details:

The report categorizes transactions under the names of the committees and presents the following details for each transaction:

- Transaction Date: The date when the transaction occurred.

- Account Category: The financial category to which the transaction is attributed.

- Bank Account: Indicates the bank account that was used for the transaction.

- Name: The entity or individual associated with the transaction.

- Check Number: If applicable, the check number associated with the transaction.

- Memo: Additional details or notes regarding the transaction.

- Cleared: Indicates whether the transaction has been cleared by the bank.

- Amount: The monetary value of the transaction, with deposits shown in positive and withdrawals in negative.

Summary View:

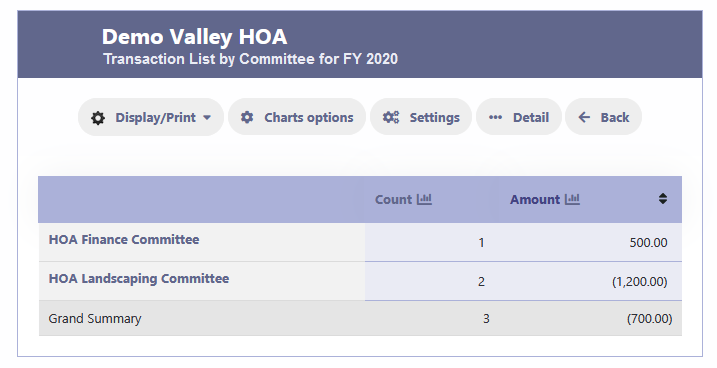

The summary view provides a concise overview of the transactions, grouping them by the committee and showing totals for each group. It includes:

- Count: The number of transactions for each committee.

- Amount: The total amount of money spent or received by each committee.

Functional Buttons:

- Display/Print: Provides options to display the report on-screen in different formats or print it. You can also export the report to PDF, Word, Excel, or other formats.

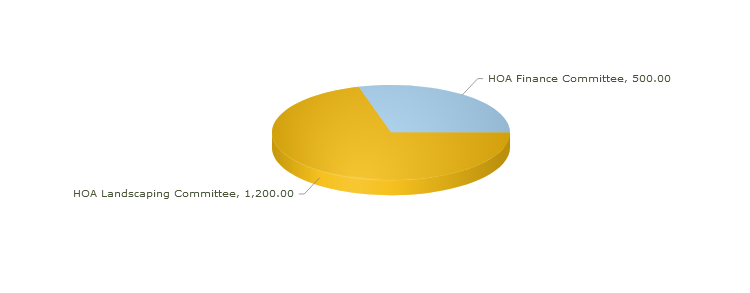

- Charts options: Offers visual representation options for the transaction data, helping to analyze the financial information graphically.

- Settings: Allows customization of the report settings.

- Detail: Toggles between a summary view and a detailed view of the transactions.

- Back: Returns to the previous screen or the transaction list search criteria input area.

Usage:

- This report is particularly useful for financial oversight, ensuring that each committee’s expenditures and income are tracked and reported accurately.

- Committee members can use this report to monitor their budgets and verify that all transactions are accounted for correctly.

Transaction Report By Contact Name

The Transaction List by Contact Name report provides a detailed account of all financial transactions associated with specific individuals or entities for a particular fiscal year. This allows for tracking of payments and expenses related to specific contacts, which is crucial for auditing and financial management.

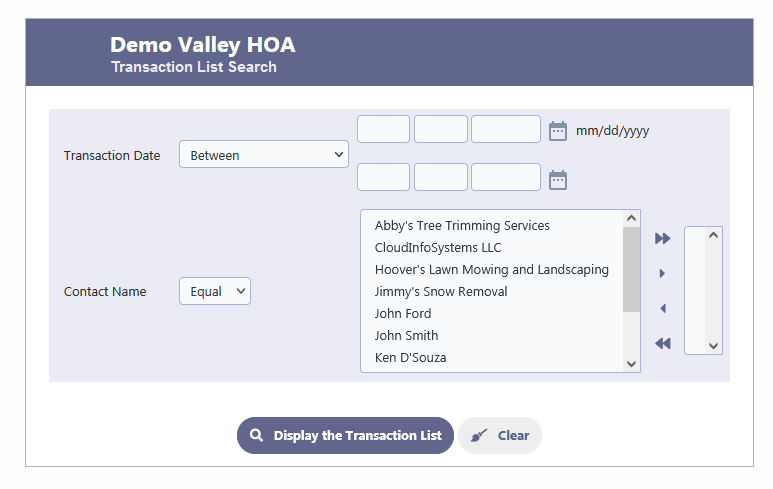

Search Criteria:

- Transaction Date: You can filter the report for transactions occurring within a specific date range.

- Contact Name: Select a contact name to view transactions associated with that individual or entity. You can choose one or multiple contacts, or leave this blank to include all contacts.

Report Details:

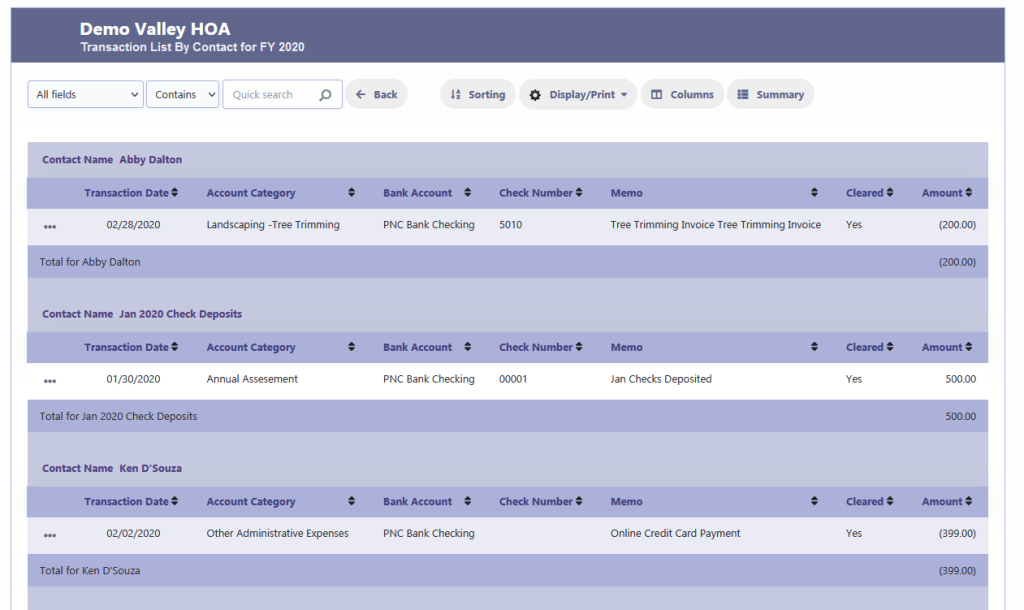

Upon selecting the criteria and clicking “Display the Transaction List,” the report will list transactions with the following details:

- Transaction Date: When the transaction was made.

- Account Category: The classification of the transaction (e.g., Landscaping, Administrative).

- Bank Account: Which bank account was involved in the transaction.

- Name: The name of the contact associated with the transaction.

- Check Number: Reference number for checks.

- Memo: Additional notes about the transaction.

- Cleared: Indicates whether the transaction has been cleared.

- Amount: The financial amount involved in the transaction, with incoming funds as positive and outgoings as negative.

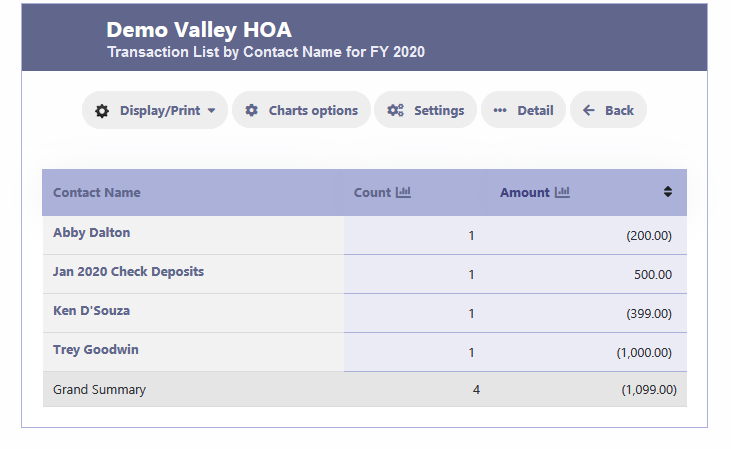

Summary View:

- The summary view condenses the report, showing the total number of transactions and the total amount of money associated with each contact.

- For example, “Abby Dalton” shows a total of one transaction with an amount of ($200.00), while “Ken D’Souza” shows one transaction with an amount of ($399.00).

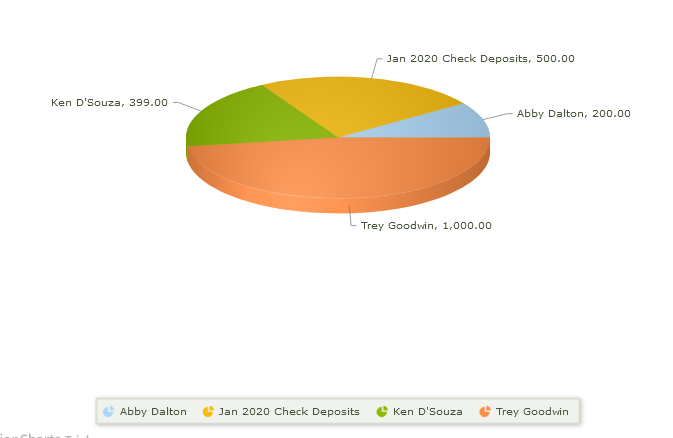

Graphical Representation:

- The graphical representation, such as a pie chart, visually breaks down the transaction amounts by contact, making it easier to understand the distribution of expenditures or income among different contacts.

Usage:

- This report is useful for managing individual account activities and ensuring transparency in financial interactions with various contacts.

- The graphical options and summary view provide quick insights into the financial relationship the HOA has with its vendors, service providers, and members.

Navigation and Customization:

- Users can utilize the “Quick search” function to find transactions associated with a contact quickly.

- The “Columns” button allows for the customization of visible data fields to tailor the report to specific needs.

- Pagination controls enable navigation through multiple pages of transaction data if the report is extensive.

This report assists in financial tracking by displaying detailed transactions associated with contacts, aiding in the reconciliation of accounts and verification of payments and charges.