How Can We Help?

Income Statement

Overview

The Income Statement is a crucial feature within the RunHOA financials suite. It provides a comprehensive report on the organization’s financial performance over a specific period, typically within a fiscal year. This report is essential for the management of HOAs, as it helps in understanding the financial status in terms of income and expenses.

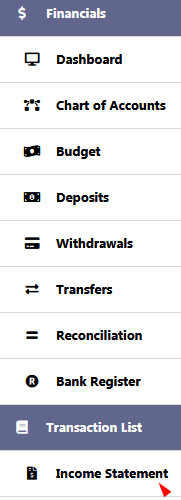

Accessing the Income Statement

- Navigate to the ‘Financials’ section in the RunHOA dashboard.

- Click on ‘Income Statement’ to access the report for the current fiscal year.

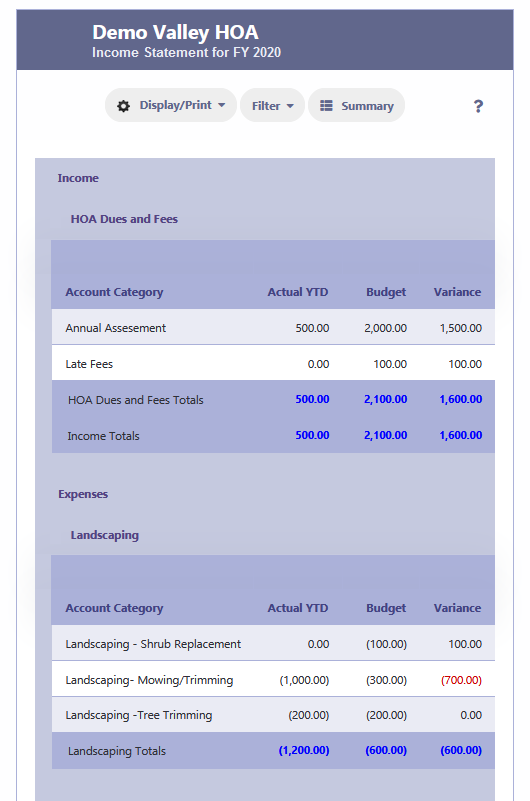

Key Components

- Actual YTD: Reflects the actual Year-To-Date financial transactions.

- Budget: Displays the budgeted figures for the fiscal year.

- Variance: Shows the difference between the actual amounts and the budgeted figures.

- Monthly Amounts: Offers a breakdown of financials on a monthly basis.

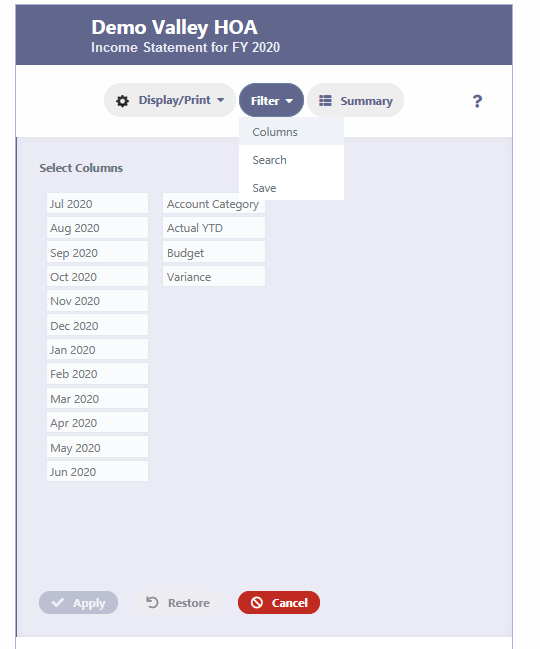

Customizing the Report

- Filter Columns: You can customize the report to display monthly amounts or other specific financial data.

- To view particular months, such as January and February 2020, you can adjust the columns to reflect these periods.

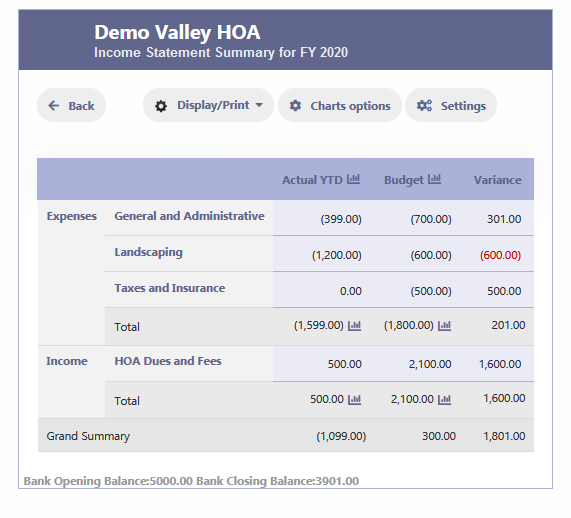

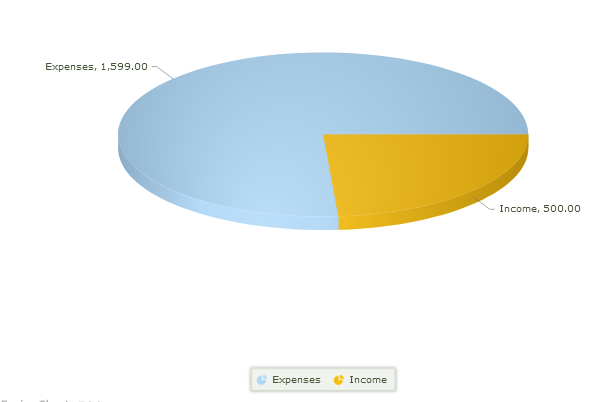

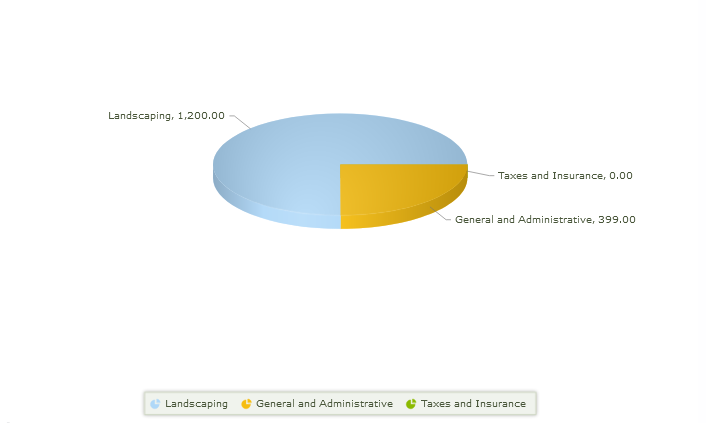

Summarized View and Graphical Representation

- By selecting ‘Summary’, you can view a condensed version of the Income Statement.

- Graph icons available in the summary view allow you to visualize the data, providing a graphical representation of the Income Statement for better analysis.

Tips for Effective Use

- Regular Review: Regularly review the Income Statement to keep track of financial performance against the budget.

- Variance Analysis: Pay attention to the Variance column to understand where the actual figures diverge from the budget.

- Trend Spotting: Use the monthly breakdown to spot trends or issues that may require attention or adjustment in the budget.

- Graphical Analysis: Take advantage of the graphical representations to present financial data to the board or members in a user-friendly format.

Remember that a well-maintained Income Statement can provide valuable insights into the financial health of your HOA, aiding in strategic decision-making and ensuring financial accountability.