How Can We Help?

Yearly Transition

Overview

The Yearly Transition feature in RunHOA Financials is a critical function used to close out the books for the current financial year and prepare the system for the new year. This process is typically carried out once a year after December 31st and ensures that fiscal year is changed and all closing balances is rolled over to the next period.

When to Run the Yearly Transition

The transition should be conducted after the end of the fiscal year, once all financial activities for the year have been completed and reconciled. This is to ensure that the opening balances for the new financial year are accurate and reflect all transactions from the previous year.

Steps for Processing the Yearly Transition

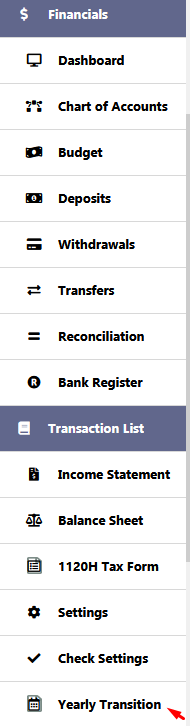

- Navigate to the ‘Yearly Transition’ option under the ‘Financials’ section in RunHOA.

- Review the financial year details, such as the start and end dates, to ensure that you are closing the correct year.

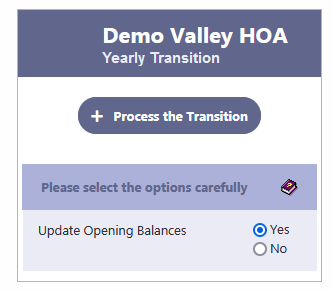

- Observe the ‘Update Opening Balances’ option. By selecting ‘Yes’, you are instructing RunHOA to carry forward the closing balances of the current year to become the opening balances for the new year.

- This is important for maintaining continuity in your financial records and ensuring that the new year’s accounts start with the correct figures.

- Click on ‘Process the Transition’ to initiate the process.

- A warning prompt may appear, reminding you to check all entries carefully before proceeding as this process can significantly affect your financial data.

Important Considerations

- Before initiating the yearly transition, ensure that all financial entries for the year are complete and accurate.

- Confirm that bank reconciliations are up to date, and all transactions are correctly cleared.

- Only authorized personnel with a clear understanding of the financial processes should carry out the transition to avoid errors.

Post-Transition

Once the transition process is complete, review the opening balances for accuracy and update it with the actual bank opening balance. The new financial year will now be active, and all new transactions should be recorded against this period. Please note that your prior year data remains unchanged.

You can access your previous financial year data anytime by updating the fiscal year under Administration > Setup > Financials Info > Financial Year.

Change it back to the current fiscal year once you are done reviewing the prior year’s transactions.