How Can We Help?

Bank Reconciliation

Overview

Bank Reconciliation within RunHOA is a critical accounting function that ensures the association’s financial records agree with the bank statements. This process involves matching the balance of cash in the organization’s financial records to the corresponding amount on its bank statement, confirming that payments have been processed and cash collections have been deposited into the bank account.

Step-by-Step Instructions for Bank Reconciliation

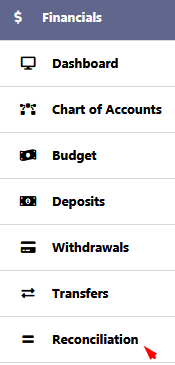

1. Start the Reconciliation Process

- Click on ‘Reconciliation’ in the Financials menu.

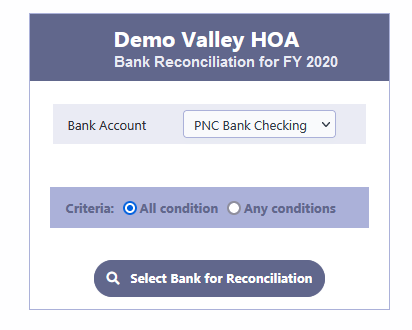

- Select ‘Select Bank for Reconciliation’ to choose the bank account you wish to reconcile.

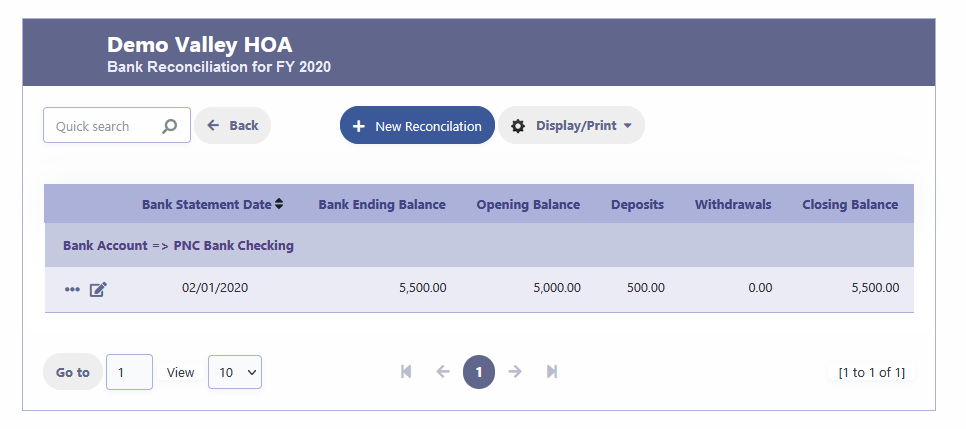

2. Review Past Reconciliations

- The next screen will display a list of reconciliations already completed for the selected bank account.

- To create a new reconciliation record, click ‘New Reconciliation’.

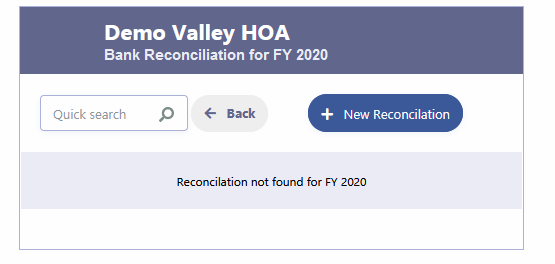

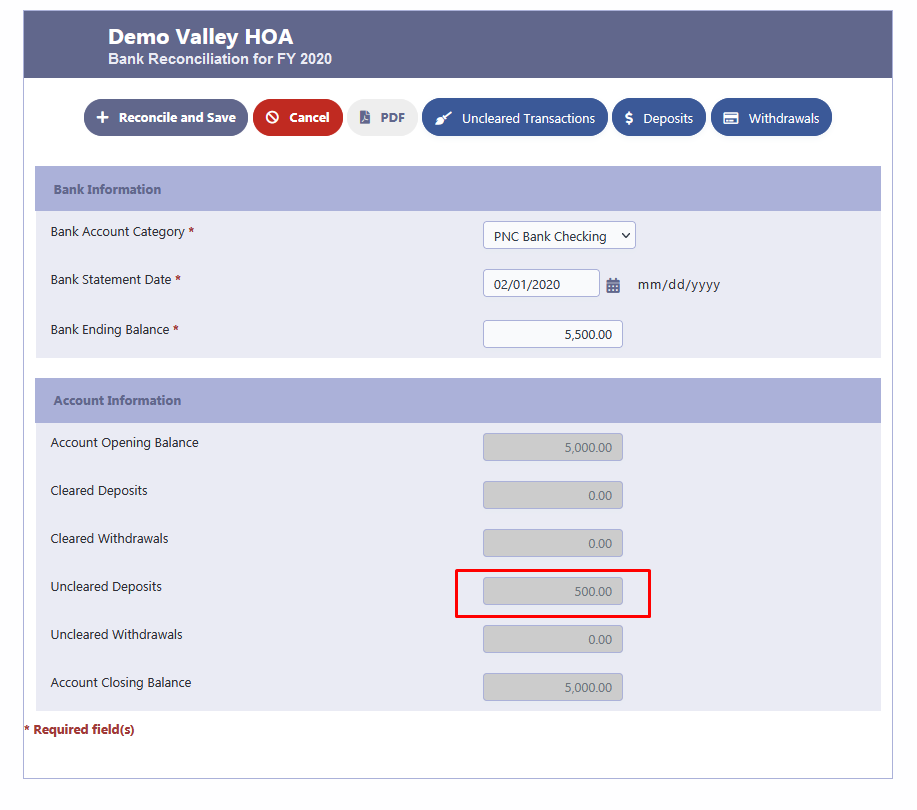

3. Enter Reconciliation Details

- Input the ‘Bank Statement Date’—the date which the bank statement was issued.

- Enter the ‘Bank Ending Balance’ as shown on the statement.

4. Perform Reconciliation

- Click ‘Reconcile and Save’ to begin the reconciliation process.

- The system will show the difference amount and provide an error message if the amounts do not reconcile.

5. Troubleshoot Reconciliation Differences

- Confirm the ‘Bank Ending Balance’ is entered correctly.

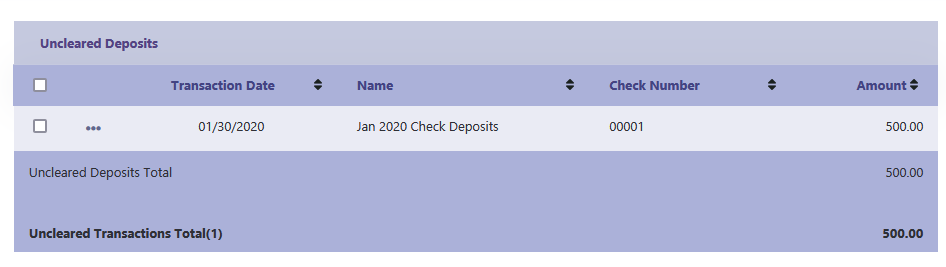

- Verify the status of checks by reviewing ‘Uncleared Transactions’.

- Check if any deposits, withdrawals, or transfers have been entered incorrectly or if new transactions need to be recorded.

- Clear any transactions that should be marked as cleared by selecting them and updating their status.

6. Clear Previous Transactions

- Ensure that any uncleared transactions from the previous period are reviewed and updated.

7. Repeat Reconciliation

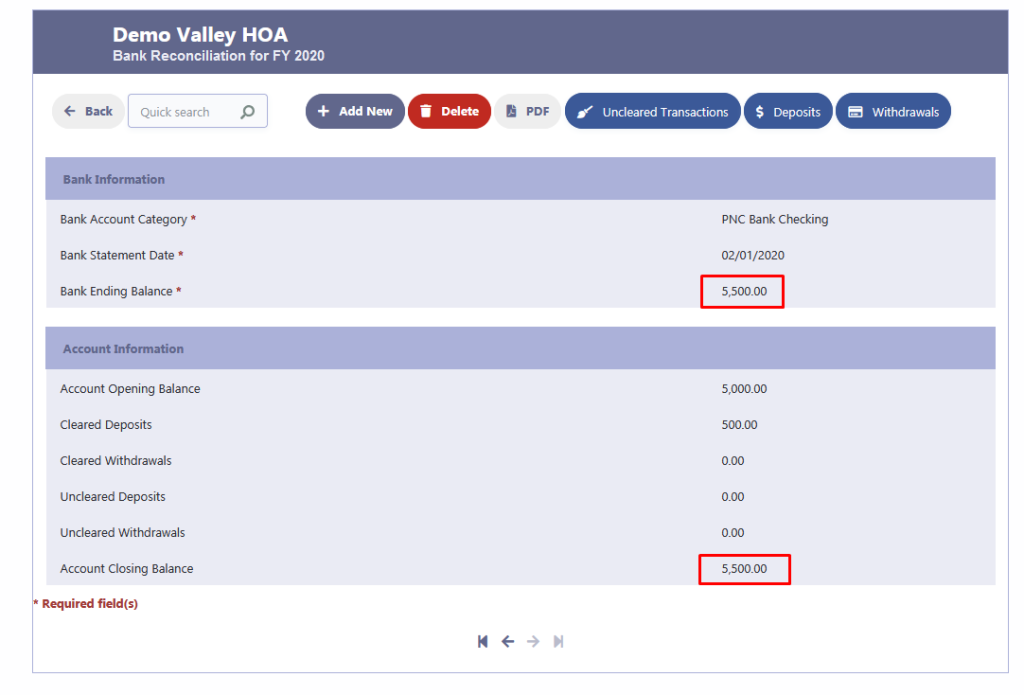

- After adjustments, click ‘Reconcile and Save’ again to attempt to reconcile.

- The system will save the record once the books are balanced.

8. Finalize and Document

- Once the reconciliation is successful with no differences, the transaction can be finalized.

- Use ‘Display/Print’ to export the reconciliation data to PDF, Word, Excel, or print format for record-keeping.

9. Monthly Reconciliation

- It’s good practice to perform bank reconciliation at the start of each month for the preceding month to keep financial records up to date.

- Bank reconciliation is a vital monthly task that ensures the integrity of financial reporting and aids in the detection of any discrepancies, errors, or fraudulent activities.

- It is crucial that all entries are accurate and that any outstanding items are addressed promptly.