HOA Debt collection is a critical aspect of managing a Homeowners Association (HOA), ensuring financial stability and fairness for all members. Handling delinquencies tactfully yet effectively is key to maintaining a positive community environment while safeguarding the association’s fiscal health. This comprehensive guide outlines a step-by-step approach to creating and implementing a robust debt collection system within your HOA.

Understanding the Importance of an HOA Debt Collection System

Before diving into the specifics, it’s crucial to acknowledge the significance of a systematic approach to debt collection. Not only does it ensure consistent and fair treatment of all homeowners, but it also helps in maintaining the association’s cash flow, contributing to the overall well-being and operational capacity of the community.

A. Assessing Your Current Situation

- Audit Existing Debts: Begin by assessing the current financial landscape of your HOA. Identify outstanding debts, their duration, and any patterns or common reasons behind the delinquencies.

- Review Governing Documents: Your HOA’s bylaws and covenants, conditions, & restrictions (CC&Rs) provide the legal framework for your debt collection process. Ensure that your intended policies align with these documents.

B. Creating a Debt Collection Policy

- Policy Development: Draft a comprehensive debt collection policy that outlines the procedures for addressing delinquent accounts. This policy should include timelines for notices, fees, and interest on overdue payments.

- Transparency and Communication: Clearly communicate this policy to all homeowners. Transparency about the process can often incentivize timely payments and reduce future delinquencies.

- Legal Compliance: Verify that your policy complies with state laws and regulations regarding debt collection. Consulting with a legal expert specializing in HOA law can provide valuable insights.

C. Implementing the System

- Billing System: Utilize a reliable billing system that tracks payments, sends reminders, and flags delinquent accounts automatically.

- First Notice: Upon a payment becoming overdue, send a polite yet firm initial notice reminding the homeowner of their obligation, outlining the potential consequences of continued non-payment.

- Escalation Process: Define a clear escalation process for accounts that remain unpaid. This may include additional notices, late fees, and ultimately, legal action if necessary.

D. Handling Delinquencies

- Payment Plans: Offer structured payment plans for homeowners facing financial hardships. Flexibility can often lead to quicker debt resolution.

- Dispute Resolution: Establish a fair process for homeowners to dispute charges they believe are incorrect.

- Legal Action: As a last resort, legal action may be necessary. Ensure that all steps leading up to this point are well documented.

E. Maintaining Relations and Community Health

- Empathy and Respect: Always approach debt collection with empathy and respect. Many homeowners may be experiencing genuine financial difficulties.

- Regular Updates: Keep the community informed about the overall financial health of the HOA and the importance of timely payments for communal benefits.

- Seek Feedback: Open channels for feedback on the debt collection process and be willing to make adjustments as needed.

F. Continuous Improvement

- Policy Review and Adjustment: Regularly review the effectiveness of your debt collection system. Adjust policies and procedures based on what’s working and what’s not.

- Stay Informed: Keep abreast of changes in laws and best practices in HOA management and debt collection.

G. Leveraging Technology

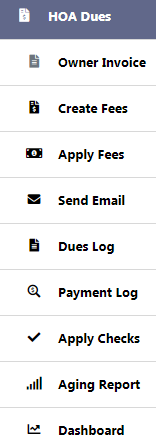

- Software Solutions: Consider adopting HOA management software that includes features for billing, debt tracking, and communication. Technology can significantly streamline the debt collection process.

Conclusion

Creating and implementing a structured debt collection system in your HOA is essential for financial stability and community harmony. By establishing clear policies, maintaining open lines of communication, and approaching delinquencies with empathy, HOAs can navigate the sensitive area of debt collection effectively. Remember, the goal is not just to collect debts but to do so in a manner that preserves the integrity and cohesiveness of the community.